Simple payroll calculator

Use this free online payroll calculator to estimate gross pay deductions and net pay for your employeesor yourself. Your household income location filing status and number of personal exemptions.

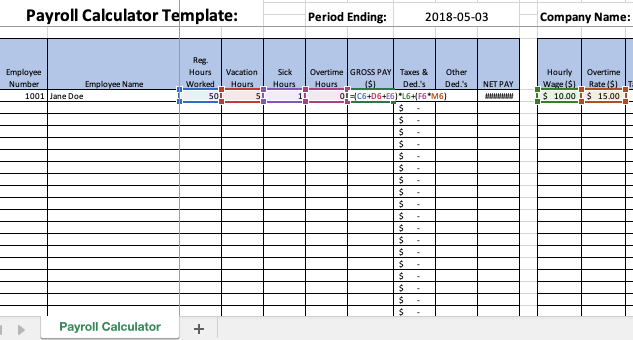

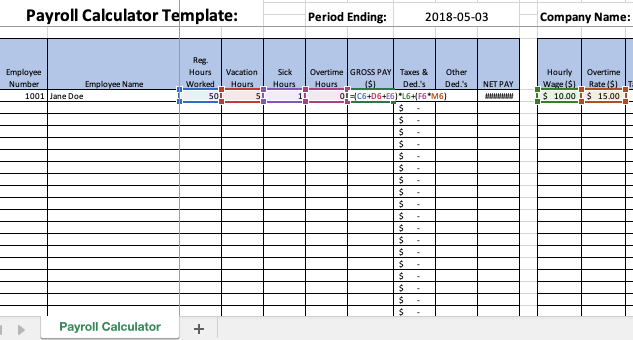

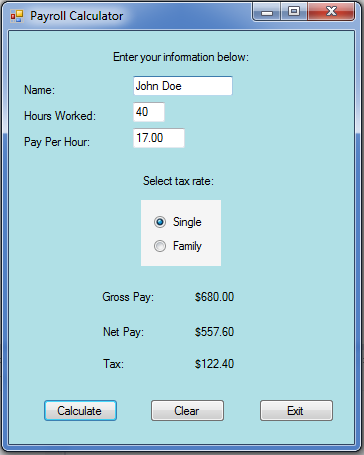

Payroll Calculator Hotsell 52 Off Www Wtashows Com

You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions.

. Why Gusto Payroll and more Payroll. This lets us find the most appropriate writer for any type of assignment. Dont want to calculate this by hand.

To start complete the easy-to-follow form below. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. After that the calculator will process their gross pay net pay and deductions for both Pennsylvania and Federal taxes.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. It is perfect for small business especially those new to payroll processing. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

When you use our payroll calculator all you have to do is enter wage and W-4 information for your employees. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Financial reporting and even payroll simple and convenient. Our free timesheet calculator will then create a simple time sheet report with totals for your daily andor weekly employee work hours. 3 Months Free Trial.

Browse accountants in our Partner Directory. This number is the gross pay per pay period. The payroll calculator from ADP is easy-to-use and FREE.

Small Business Low-Priced Payroll Service. What we do what you do. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance.

Payroll jobs up in 99 08302022 July job openings change little. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period. It will confirm the deductions you include on your official statement of earnings.

Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. All you need to do is enter each employees wage and W-4 information. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

April Young Ultimate Properties. The reliability of the calculations produced depends on the. Determine the right amount to deduct from each employees paycheck.

They make it simple and easy. Starting as Low as 6Month. Keep more of what you earn today.

We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Which tax rates apply. However it isnt.

08312022 July jobless rates down over the year in 383 of 389 metro areas. Time tracking software used by millions. Choose your state below to find a state-specific payroll calculator check 2022 tax rates and other local information.

Hires and total separations also change little 08262022 From 2019 to 2021 36 million workers displaced from jobs they held for. Pennsylvania state income taxes are relatively simple with a 307 flat income tax rate. Try online payroll today.

The process is simple. It should not be relied upon to calculate exact taxes payroll or other financial data. But these cities charge an additional income tax ranging from 15 to 24 for Michigan residents.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. It can be used for the 201314 to 202122 income years. The PaycheckCity salary calculator will do the calculating for you.

We wouldnt use any other payroll solution and recommend them to any small business owner. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net pay for both federal and state taxes. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

Clockify is a time tracker and timesheet app that lets you track work hours across projects. Information you need for this calculator. Thats where we come into play.

Our automated solutions are packed with all the features you need to take full control and manage compliance in your payroll operations. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Our payroll calculator will take care of the rest.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. Before you use the calculator. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

Youll need to gather information from payroll to calculate employee withholding tax. Important Note on Calculator. You assume the risks associated with using this calculator.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Total Earning Salary. Luckily our payroll tax calculator is here to help the wide range of small businesses Michigan has to offer.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. In addition to hours and pay rates you need to calculate and file FICA state and local taxes if applicable for you and your employees. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Unfortunately payroll isnt that simple. Summarize deductions retirement savings required taxes and more. What this calculator doesnt cover.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Determine your taxable income. In addition QuickBooks Online can help you maximize your tax deductions.

The Ascentis payroll system helps ensure your employees are paid on time securely and with 100 accuracy to build trust and protect your strong reputation as an employer. Heres the information youll need for your calculations. PaycheckCity Payroll has made us more productive and has saved hundreds of hours of time when running our payroll.

Fast and basic estimates of Fed State Social Security Medicare taxes etc. Calculating paychecks and need some help. The calculator automatically totals up all work hours and attendance entries while generating the.

Automatic deductions and filings direct deposits W-2s and 1099s. Simple steps to run payroll add benefits and more. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada. The most popular free time tracker for teams. Employers can use it to calculate net pay and figure out how much to withhold so you can.

Its a simple four-step process. Salary Paycheck and Payroll Calculator.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com

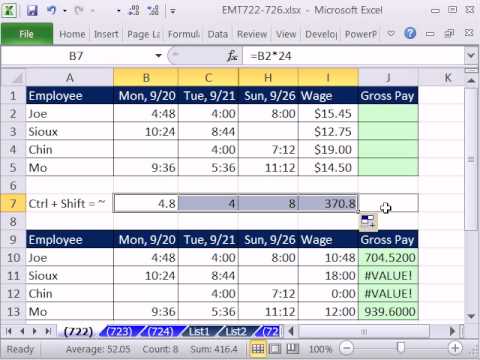

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Sample Resume

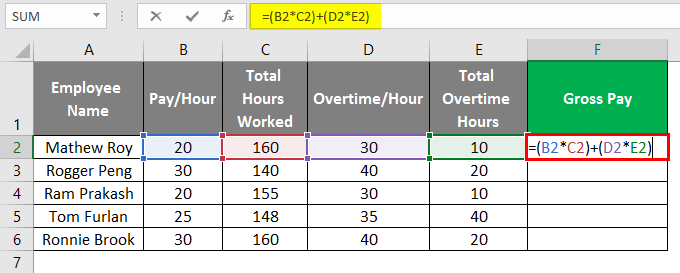

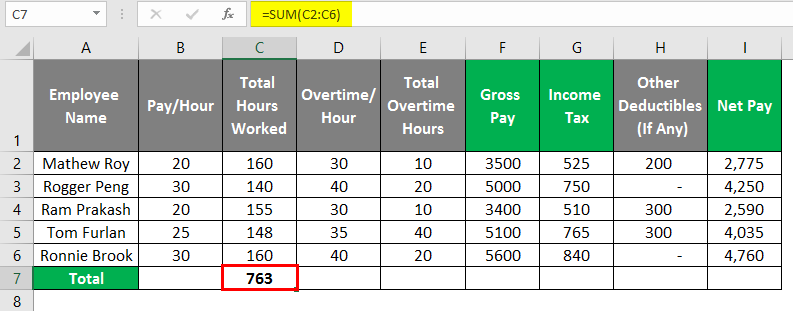

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Payroll Hours Calculator Store 55 Off Www Wtashows Com

Free Time Card Calculator For Excel Templates Printable Free Card Templates Free Card Templates

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Bookkeeping Templates Payroll Template

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com

Payroll Calculator Hotsell 52 Off Www Wtashows Com

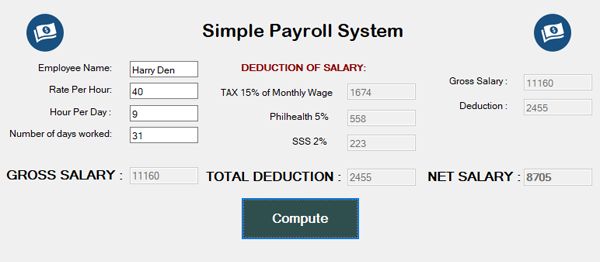

Simple Payroll System In Vb Net With Source Code Source Code Projects

Payroll Hours Calculator Cheap Sale 53 Off Www Wtashows Com